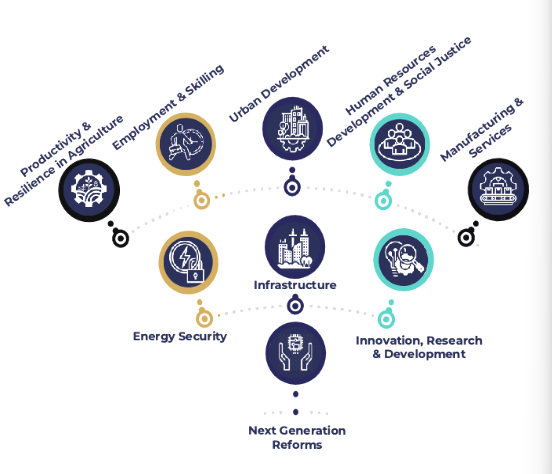

The India Union Budget 2024 is clear evidence of India’s forward momentum towards “Amrit Kaal,” marking a pivotal step towards achieving ‘Viksit Bharat.’ This budget presents a detailed and strategic roadmap, highlighting a robust commitment to nine key priorities.

Here, we provide a concise overview of the Finance Bill’s provisions, encompassing direct tax, indirect tax, and transfer pricing measures. Our analysis highlights the key aspects and implications of these provisions, offering valuable insights for businesses and individuals alike.

Explore our comprehensive breakdown to understand how the Union Budget 2024 is steering India towards a prosperous future.

Direct Tax Proposals

Tax Rates And Taxation Of Individuals

- No change proposed in rebate, surcharge and health and education cess. Maximum surcharge under new regime continues to be at 25% and under old regime it is 37%.

- Standard deduction for salaried individuals increased from INR 50,000 to INR 75,000.

- Deduction to the family members of deceased employee from pension income increased from INR 15,000 to INR 25,000.

- Proposed slab rates under the new regime (default regime) for individuals or Hindu undivided family or association of persons or body of individuals, whether incorporated or not, or every artificial juridical person:

| Existing slab rates – AY 2024-25 | Amended slab rates – AY 2025-26 onwards | |||

| Income (in INR) | Rates | Income (in INR) | Rates | |

| Up to 3,00,000 | Nil | Up to 3,00,000 | Nil | |

| 3,00,001 – 6,00,000 | 5% | 3,00,001 – 7,00,000 | 5% | |

| 6,00,001 – 9,00,000 | 10% | 7,00,001 – 10,00,000 | 10% | |

| 9,00,001 – 12,00,000 | 15% | 10,00,001 – 12,00,000 | 15% | |

| 12,00,001 – 15,00,000 | 20% | 12,00,001 – 15,00,000 | 20% | |

| Above 15,00,000 | 30% | Above 15,00,000 | 30% | |

Tax rates under old regime

- No change in old regime (optional)

- Slab rates under old regime:

| Income (in INR) | Age less than 60 years | Age 60 Years or more but less than 80 years | Age less than 80 years or more |

| Up to 2,50,000 | Nil | Nil | Nil |

| 2,50,001 – 3,00,000 | 5% | Nil | Nil |

| 3,00,001 – 5,00,000 | 5% | 5% | Nil |

| 5,00,001 – 10,00,000 | 20% | 20% | 20% |

| Above 10,00,000 | 30% | 30% | 30% |

Tax Rates And Taxation Of Individuals

Contribution to National Pension Scheme

- It is proposed to insert a proviso under section 80CCD to allow a deduction to employees for contribution to NPS by an employer (other than Central Government or State Government) up to 14% as against 10% allowed earlier.

- The amendment shall be applicable from April 1, 2024.

Donation to National Sports Development Fund

- The existing provisions of Section 80G(2)(a)(iiihg) is proposed to be amended to provide for a deduction from total income of any sum paid as donation to the “National Sports Development Fund set up by the Centra Government”, which was earlier “National Sports Development Fund to be set up”.

- The amendment shall be applicable from April 1, 2024.

Business / Corporate Taxation

Reporting of Income from letting out of house property

- An explanation under section 28 of the Act has been inserted to clarify that any income from letting out of residential house shall be chargeable under the head ‘Income from house property’ and not under the head ‘profits and gains of business or profession’.

Disallowance of amounts paid to settle contraventions

- Currently, expenditure incurred towards offence or contravention of law, including amounts paid for compounding of offences are not allowable.

- It is now proposed to disallow settlement amounts that are incurred due to an infraction of law and relate to contraventions as well.

Increase in deduction of remuneration to working partners

- Currently, remuneration paid to a working partner above a particular threshold is disallowed.

- With effect from April 1, 2024, the remuneration to working partners allowed as deduction is amended as below:

| Book Profit | Remuneration allowable | |

| (a) | On the first INR 6,00,000 (revised from INR 3,00,000) of the book-profit or in case of a loss | INR 3,00,000 (revised from INR 1,50,000) or at the rate of 90 percent of book-profit, whichever is more; |

| (b) | On the balance of the book-profit | At the rate of 60 percent |

Prevention of misuse of deduction of expenses claimed by life insurance business

- Income of a life insurance business is computed in consonance with the Rules laid under the First Schedule of the Act.

- However, provisions dealing with allowability of expenses in case of income from profits and gains were not applicable to such businesses.

- It is proposed that only expenses eligible under section 37 of the Act shall be allowed while calculating profits and gains of life insurance business.

Capital Gains

New holding period in case of Capital Gains

(applicable from July 3, 2024)

| Sr. No. | Asset class | Holding period |

| 1 | All listed securities | 12 months |

| 2 | Unlisted securities, immovable properties, unlisted bonds, unlisted debentures, physical gold | 24 months |

New tax rates for following Capital Gains

(applicable from July 23, 2024)

| Sr. No. | Asset class | Period of holding | Applicable section | Tax rate |

| 1 | STT paid equity shares, units of equity-oriented funds, units of business trust | Short-term | 111A | 20% |

| 2 | STT paid equity shares, units of equity-oriented funds, units of business trust | Long-term (No indexation Benefit Available) | 112A | 12.5% (on gains exceeding Rs. 125 lakhs) |

| Equity shares (STT not paid including OFS), Listed bonds, Listed debentures, immovable property*, Mutual funds (equity held more than 35% but less than 65%), Other assets | Long-term (No indexation Benefit Available) | 112 | 12.5% | |

| 3 | Market-linked debentures, specified mutual funds (debt oriented i.e., more than 65% in debt), unlisted bonds & unlisted debentures. | Short-term (irrespective of holding period) | 50AA | At slab rates applicable |

*In case of immoveable property, FM has clarified that properties bought before 2001 stand grandfathered i.e. they will enjoy a valuation as of Apr 2001 to be claimed as cost. Indexation will however still not be available post 2001 even in such cases.

Note: Parity for capital gains for NRIs in line with residents. Aforesaid changes with respect to tax rates being proposed in section 115AB (Units purchased in foreign currency), section 115AD (Foreign Institutional Investors), section 115AC, section 115ACA (Global Depository Receipts) and section 115E (Investment income for NRIs)

Capital Gains

Capital Gains tax rates (Old vs. New):

| Sr.No. | Particulars | Old | New | |

| A. | Short term capital gains | |||

| 1. | Equity shares (STT paid), units of equity oriented mutual funds, units of business trust | 15% (under section 111A) | 20% | |

| B. | Long term capital gains | No indexation available | ||

| 1. | Equity shares (STT paid) and units of equity oriented mutual funds, units of business trust (REIT, INvit) | 10% (under section 112A) | 12.5% (on gains exceeding Rs. 125 lakhs) | |

| 2. | Listed bonds and debentures | 10% (under section 112) | 12.5% | |

| 3. | Unlisted bonds and debentures | 20% (under section 112) | Slab rates, short term – irrespective of holding period (under section 50 AA) | |

| 4. | Equity Shares (STT not paid including OFS) | 20% (under section 112) | 12.5% | |

| 5. | Immovable property* , other assets | 20% (under section 112) | 12.5% | |

| 6. | Market Linked Debentures, specified mutual funds (debt oriented i.e. more than 65% in debt) | Slab rates, short term – Irrespective of holding period (under section 50AA) | Slab rates, short term – Irrespective of holding period (under section 50AA) | |

| 7. | Mutual funds (equity more than 35% but less than 65%) | 20% (under section 112) | 12.5% | |

*In case of immoveable property, FM has clarified that properties bought before 2001 stand grandfathered i.e. they will enjoy a valuation as of Apr 2001 to be claimed as cost. Indexation will however still not be available post 2001 even in such cases.

Capital Gains

Redefining ‘specified mutual funds’ under explanation of section 50AA

- It is proposed to amend the definition of “Specified Mutual Fund” under clause (ii) of Explanation of section 50AA to provide that a specified mutual fund shall mean a mutual fund:

(a) a Mutual Fund by whatever name called, which invests more than sixty five per cent of its total proceeds in debt and money market instruments; or

(b) a fund which invests sixty five per cent or more of its total proceeds in units of a fund referred to in sub-clause (a).

- This amendment shall be applicable from April 1, 2025

Buyback to be treated as dividend in the hands of shareholders

- Consideration received upon buyback of shares in the hands of shareholders bought on par with dividends. Further, the cost of shares tendered for buyback to be claimed as capital loss as sales consideration being deemed to be Nil.

- This amendment shall be applicable from October 1, 2024

Exemption from ‘transfer’ of certain assets to be available only to Individual and HUF

- Section 47(iii) has been amended to provide exemption only to an individual and HUF in respect of transfer of capital asset under a gift or an irrevocable trust.

Clarifying FMV in an instance of exit via offer for sale where listing of an equity share is subsequent to the date of transfer

- In a case where unlisted shares are held on January 31, 2018 and sold via an offer for sale, it has been clarified (with retrospective effect) that the cost shall be computed by indexing the original cost up to January 31, 2018.

- This amendment shall be applicable retrospectively from AY 2018-19 onwards.

Other Sources

Abolishment of Section 56(2)(viib):

- The existing provisions of section 56(2)(viib) provide that where a company, not being a company in which the public are substantially interested, receives, in any previous year, from any person, any consideration for issue of shares, exceeding the face value of such shares, the aggregate consideration received for such shares as exceeds such fair market value is chargeable to income tax under the head “Income from other sources”.

- It has been proposed that the provisions of section 56(2)(viib) shall not apply from 1 April 2024.

Special Procedure For Assessment Of Search Cases

- A new chapter has been introduced as ‘Chapter XIV-B’ for Search & Seizure. This shall now be assessed under the provisions of Section 158B to 158BI of the Act.

- ‘Block period’ has been defined which includes total 6 preceding assessment years and part of the year starting from April 1 up to the conclusion of search.

- ‘Undisclosed Income’ has been defined to include any money, bullion, jewellery or other valuable article or thing or any expenditure or any income based on any entry in the books of account or other documents or transactions, where such money, bullion, jewellery, valuable article, thing, entry in the books of account or other document or transaction represents wholly or partly income or property which has not been or would not have been disclosed for the purposes of this Act, or any expense, deduction or allowance claimed under this Act which is found to be incorrect.

- All the ongoing assessment/reassessments shall abate.

- The total income (other than undisclosed income) shall be assessed separately in accordance with the other provisions of the Act and undisclosed income would be assessed at the rate of 60% as per Section 158BB read with Section 113.

- As per section 158BF, no additional surcharge or interest under sections 234A, 234B or 234C or penalty under section 270A shall be levied.

- Further, as per section 158BFA, penalty shall be levied at fifty per cent of the tax on undisclosed income not offered in the return of income filed in compliance to the notice issued under section 158BC.

Rationalisation Of Reassessment Provisions

Existing reassessment provisions

- Under the existing provisions, the AO issues a show cause notice under section 148A which prescribes a maximum period of 30 days for the taxpayer to file a response (in addition to any extension sought by the taxpayer).

- After considering the taxpayer’s response, the AO may pass an adverse order under section 148A(d) and issue notice under section 148. The taxpayer must file an ITR within three months from the end of the month (plus any extension sought by the taxpayer) and then the AO commences the reassessment proceedings.

- The AO must have such information for initiating reassessment:

- Information from – Insight portal, Audit Objections, Information under DTAA, order of Court/Tribunal, etc.

- Deemed information – from Searches, Surveys, requisitions, etc.

- However, in cases where information is obtained from Search proceedings and Insight portal, the AO can skip the show cause notice and directly direct the taxpayer to file an ITR and commence reassessment by issuing notice under section 148 of the Act.

What is modified?

- Existing section 148 and section 148A have been substituted with an amended section 148 and section 148A to provide for the following modifications:

- The taxpayer cannot seek any extension in filing the response or for filing ITR;

- The reassessments relating to search (in case of the assessee or search in case of another party) are excluded from existing reassessment regime. These will now be governed under the new provisions for Search under Chapter XIV-B.

- The above amendments shall be applicable from September 1, 2024.

Rationalisation Of Reassesment Provisions

Time limit to issue reassessment notice

- Section 149 of the Act provides for time limits for issue of notices for reassessment proceedings. This has been proposed to be substituted with amended section 149 reducing the time limit by which a notice for reassessment can be issued.

- A comparative chart of the old and the amended provisions are tabulated below.:

A. Time limit for issuing notice under section 148 – No notice under section 148 is to be issued

| Existing provision | Amended provision | |

| Sub-section 1 | ||

| Clause (a) | beyond three years from the end of the relevant assessment year, unless the case falls under clause (b): | beyond three years and three months from the end of the relevant assessment year, unless the case falls under clause (b) |

| Clause (b) | beyond ten years from the end of the relevant assessment year | beyond five years and three months, from the end of the relevant assessment year |

| Clause (b) is applicable where the income escaping assessment amounts to or is likely to amount to INR 50 lakhs or more. | ||

Time limit for issuing show cause notice under section 148A –

- Section 151 of the Act mandates sanction to be obtained from the specified authority for issuance of notice under section 148 or section 148A of the Act which varies with time limits.

- It is proposed that the specified approving authority for this purpose shall be the Additional Commissioner or the Additional Director or the Joint Commissioner or the Joint Director irrespective of time limit of issuance of notice under section 148 and section 148A.

- The above amendment shall be applicable from September 1, 2024.

Sanction from specified authority

As per sub-section 2 to the amended section 149, no show cause notice under section 148A is to be issued:

(a) beyond three years from the end of the relevant assessment year;

(b) beyond five years from the end of the relevant assessment year unless the income chargeable to tax which has escaped assessment amounts to or is likely to amount to INR 50 lakhs or more.

The above amendments shall be applicable from the September 1, 2024.

Rationalisation Of Reassessment Provisions

Other provisions

- It is proposed to amend section 152 of the Act to provide for applicability of provisions of section 147 to 151 as they stood immediately before the commencement of the Finance (No. 2) Act, 2024 in case of the following:

- where a search has been initiated under section 132 or requisition is made under section 132A or a survey is conducted under section 133A [other than under sub- section (2A)] on or after April 1, 2021 but before September 1, 2024.

- where a notice under section 148 has been issued or an order under section 148A(d) has been passed prior to September 1, 2024.

- However, in cases where information is obtained from Search proceedings and Insight portal, the AO can skip the show cause notice and directly direct the taxpayer to file an ITR and commence reassessment by issuing notice under section 148 of the Act.

Time limits for passing order

Section 153 of the Act specifies the timelines for passing assessment, reassessment and re-computation orders. The following amendments have been proposed to section 153:

- A new sub-section (1B) is proposed to be inserted to include the completion of assessment in case of returns filed in compliance to order under section 119(2)(b) of the Act. The same is to be completed within 12 months from the end of the financial year in which the return is furnished.

- Section 153(3) is amended to include the time limit for completion of cases set aside by the Commissioner (Appeals) vide order under section 250 of the Act along with the cases set aside by ITAT vide order under section 254 of the Act.

- Section 153(8) is amended to provide for timeline for passing of order in case of revived assessment or reassessment proceedings as a consequence of section 158BE/ section 158BA(5) along with earlier revivals under section 153B/section 153A(2) of the Act.

- A new provision (6th proviso) is proposed to be inserted to Explanation 1(xii) of section 153 to provide that in computing the period of limitation any period (not exceeding one hundred and eighty days) commencing from date of initiation of search and ending on the date on which the books of account/documents/seized materials are handed over to the Assessing Officer, falling in the middle of the month, such shall be taken as end of the month for exclusion.

- The above amendment shall be applicable from October 1, 2024.

Penalties And Prosecution

Penalty for furnishing inaccurate information in financial statements

- Any persons who file inaccurate SFT or fails to furnish correct information under section 285BA(6) or fails to comply with due diligence specified under section 285BA(7) of the Act shall be directed to pay a penalty INR 50,000.

- However, no penalty to be levied where there exists a reasonable cause.

New penalty provisions introduced for delay in submission of statement by liaison office

- Currently, a statement is to be filed by the liaison office of non-resident within sixty days from the end of the financial year.

- It is proposed that such period shall now be prescribed under the Rules to be notified.

- Penalty of INR 1,000 per day up to three months of delay and INR 1,00,000 in any other case prescribed for failure to file such statement.

- However, no penalty to be levied where there exists a reasonable cause.

Penalty for failure to furnish statements of TDS and TCS

- Currently penalty of INR 10,000 to INR 1,00,000 will not apply where statement of TDS or TCS is filed within one year from the prescribed time limit.

- It is proposed that the such time limit is to be reduced from 1 year to 1 month.

Relaxation of provisions leading to prosecution for delayed TDS payments

- Currently, section 276B provides for imprisonment for non-payment of TDS within the prescribed due date.

- It is proposed to add a proviso wherein the due date for payment of TDS for the purpose of section 276B(a) is being extended to the due date of filing the statement required under section 200(3) for the respective quarter.

Appellate Tribunal

Increased threshold limit for filing appeals

- It is proposed to increase monetary limits for filing appeals in Tax Tribunals, High Courts and Supreme Court to INR 60 lakhs, INR 2 crores and INR 5 crores respectively.

Initiatives for digitalization of rectifications and order giving effect

- Rectification and order giving effect to appellate orders shall be digitalized and made paper-less over the next two years.

Appealable Orders before Commissioner (Appeals)

- With proposed amendment in assessment to be done for search cases, appealable orders under section 246A to include orders passed under section 158BC(1)(c).

- This amendment shall be applicable from September 1, 2024.

Enhancement in powers of Joint Commissioner (Appeals) or the Commissioner (Appeals)

- It is proposed that the cases where assessment order was passed under section 144 of the Act, Commissioner (Appeals) shall be empowered under section 251 to set aside the assessment and refer the case back to the Assessing Officer for making a fresh assessment.

- This amendment shall be applicable from October 1, 2024.

Increased timelines to file appeals to the Appellate Tribunal

- The appeal before the Appellate Tribunal may be filed within two months from the end of the month in which the order sought to be appealed against is received by the assessee or to the Principal Commissioner or Commissioner, as the case may be.

- This amendment shall be applicable from October 1, 2024.

Rationalization Of Tds Provisions

- Certain TDS rates have been amended as below:

| Provision | Old rates | New rates | Effective from | |

| Payment of insurance commission (other than company) | 5% | 2% | April 1, 2025 | |

| Payment in respect of life insurance policy | 5% | 2% | October 1, 2024 | |

| Commission, etc on sale of lottery tickets | 5% | 2% | October 1, 2024 | |

| Payment of commission or brokerage | 5% | 2% | October 1, 2024 | |

| Payment of rent by certain individuals or HUF | 5% | 2% | October 1, 2024 | |

| Payment of certain sums by certain individuals or Hindu undivided family | 5% | 2% | October 1, 2024 | |

| Payment of certain sums of e-commerce operator to e-commerce participant | 1% | 0.1% | October 1, 2024 | |

| Payments on account of repurchase of units by Mutual Fund or Unit Trust of India | 20% | Proposed to be omitted | October 1, 2024 | |

Ease in claiming credit of TCS by salaried employees

- Currently, income earned under other heads of income and any tax deducted on such income shall be taken into account for deducting TDS under the head ‘Salary’.

- It is proposed that credit of TCS shall also be considered by the employer while deducting TDS under the head ‘Salary’.

- The amendment shall be applicable from October 1, 2024

TDS on salary, interest, bonus or commission to partners

- A new TDS section has been introduced to bring payments such as salary, remuneration, commission, bonus and interest to any account (including capital account) of the partner of the firm under the purview of TDS.

- TDS shall be attracted when aggregate payments exceed INR 20,000 in a FY. The applicable TDS rate shall be 10%.

- The amendment shall be applicable from April 1, 2024

TDS on sale of immovable property

- Currently, any person paying consideration for any immovable property shall deduct TDS at 1%.

- However, the provisions are not applicable where the consideration for transfer of an immovable property and the stamp duty value of such property are both less than INR 50 lakhs.

- It is proposed that individual limit of INR 50 lakhs is no longer required to be checked where there is more than one transferor or transferee and the aggregate amount is to be seen for the purpose of TDS.

- This amendment shall be applicable from October 1, 2024.

Inclusion of taxes withheld outside India for calculating total income

- Currently, the Act provides that amount on which tax is deducted shall be deemed to be income received.

- It is proposed that all sums on which tax is paid outside India and foreign tax credit is available to an assessee shall be deemed to be income received.

- The amendment will take effect from April 1, 2024

Rationalization of section 194C of the Act

- Currently, on payments made to contractors TDS is applicable at the rate of 1% / 2% on work.

- However, there is no explicit exclusion for assessees who are required to deduct tax under section 1943 from requirement or ability to deduct tax under section 194C of the Act.

- It is proposed to explicitly exclude any sum referred to in section 1943 from the purview of ‘work’.

- The amendment will take effect from October 1, 2024.

Reducing time limitation for orders deeming any person to be assessee in default

- Currently, TDS and TCS provisions provide for consequences when a person does not deduct/collect, or does not pay, or after so deducting/collecting fails to pay, the whole or any part of the tax.

- It is proposed to amend TDS and TCS provisions to provide that no order shall be made deeming any person to be an assessee in default after 6 years (revised from 7 years) from the end of the FY in which payment is made or credit is given or tax was collectible or two years from the end of the FY in which the correction statement is delivered, whichever is later.

Widening ambit of section 200A of the Act for processing of statements other than those filed by deductor

- Section 200A of the Act provides for the manner in which statement of TDS or a correction statement shall be processed.

- It is proposed that the Board may make a scheme for processing statements which have been furnished by any other person, not being a deductor.

Extending the scope for lower deduction/ collection certificate

- Currently, payments on which tax is required to be deducted under certain sections of TDS/TCS provisions are eligible for certificate for deduction at lower rate.

- It is proposed that certificates can now be issued for lower TDS deduction under Section 194Q of the Act and lower TCS collection under Section 206C(1H) of the Act.

- This amendment shall be applicable from October 1, 2024.

Time limit to file correction statement in respect of TDS/TCS statements

- Currently, there are no time limits prescribed for filing correction statements of TDS/ TCS.

- It is proposed that TDS/TCS correction statements can be filed before the expiry of six years from the end of the financial year in which the original statements are filed.

Trusts & Charitable Institutions

Merger of Trust under section 10(23C) with Trust under sections 11 to 13:

- It is proposed to merge trusts or funds or institutions contained in the provisions of sub-clause(s) (iv), (v), (vi) or (via) of clause (23C) of section 10 (First Regime) with sections 11 to 13 (Second Regime) of the Act, thereby the trusts, funds or institutions shall be transitioned to the second regime in a gradual manner.

- No fresh application for approval under sub-clauses (iv), (v), (vi) or (via) of clause (23C) of section 10 shall be entertained on or after October 1, 2024. Pending applications as on October 1, 2024 would be processed under the extant provisions of the first regime itself.

- Approved trusts, funds or institutions under the first regime shall continue to get the benefits under section 10 till the validity of the said approval. Subsequently, these shall apply for registration under the second regime.

Condonation of delay in filing application for registration

- Delay in filing application for registration under section 12AB may be condoned by the Principal Commissioner/ Commissioner if it is considered that there is a reasonable cause shown for such delay.

Applications for registration under section 12AB or approval under section 80G

- It is proposed to dispose applications for registration under section 12AB and approvals under section 80G within six months from the end of the quarter in which the application is received from the erstwhile timelines being six months from the end of the month in which the application was received.

Merger of trusts under the exemption regime with other trusts

- It is proposed to insert section 12AC to cover cases where any trust or institution registered under section 12AB or approved under sub-clauses (iv), (v), (vi) or (via) of section 10(23C) merge with another trust or institution, to provide that the accreted income of the trust (Fair Market Value of Assets less Total Liability) shall not be taxable if the following conditions are satisfied:

- the other trust or institution has same or similar objects,

- the other trust or institution is registered under section 12AA or section 12AB or approved under sub-clauses (iv), (v), (vi) or (via) of section 10(23C), as the case may be; and

- the said merger fulfils such conditions as may be prescribed.

Others

Promotion of domestic cruise ship operations by non- residents:

- With the aim to make India an attractive cruise tourism destination, new provisions are introduced to deem 20% of the carriage amount as profits in case of non-residents engaged in operation of cruise ships.

- Further, lease rent paid by such shipping company to a foreign company who shares the same holding company shall be exempt in the hands of such foreign company until AY 2030-31.

Adjusting liability against seized assets:

- Section 132B of the Income-tax Act provides for application of seized or requisitioned assets.

- The said section provides that the amount of any existing liability under various prescribed statutes and the amount of liability determined on completion of the assessment or reassessment in consequence of search or requisition, may be recovered from the taxpayer out of the seized assets under section 132 or requisitioned under section 132.

- It has been proposed to insert reference to the Black Money Act, 2015 in the above section so as to enable recovery of existing liabilities under the said Act out of seized assets.

- This amendment shall be applicable from October 1, 2024.

Tax Clearance Certificate:

- It has been proposed from October 1, 2024, onwards that a person domiciled in India at the time of departure, shall not leave the territory of India by land, sea or air unless he obtains a certificate stating that there are no liabilities, inter alia, under the Black Money Act, 2015, or makes satisfactory arrangements for the payment of all or any of such liabilities which are or may become payable by that person under the said Act.

- The certificate is only required for person in respect of whom circumstances exist which, in the opinion of an income-tax authority, make it necessary for such person to obtain a tax clearance certificate. For doing so, the income-tax authority shall have to record the reasons therefor and obtain prior approval from the Principal CCIT/ CCIT.

- Earlier, such certificate only covered liabilities under the Income-tax Act, 1961, the Wealth-tax Act, 1957, the Gift-tax Act, 1958 and the Expenditure-tax Act, 1987.

Revision of rates of securities transaction tax

- The rates of STT are proposed to be revised as below:

- In case of sale of options – 0.1% of premium (revised from 0.0625%)

- In case of sale of futures -0.02% of traded price (revised from 0.0125%)

- This amendment shall be applicable from October 1, 2024.

Amendments in relation to International Financial Services Centre (IFSC):

- Tax exemption under section 10(4D) extended to retail schemes and Exchange Traded Funds in IFSC, similar to Category III AIFs in IFSC.

- Surcharge not applicable on income-tax payable on interest and dividend income from securities by specified funds in IFSC (i.e. Category III AIFs, retail schemes and Exchange Traded Funds).

- Exemption from justification of source of source under section 68 applicable to venture capital funds regulated by SEBI, now extended to Venture capital funds regulated by IFSCA.

- Section 94B relating to thin capitalisation norms to not apply to certain finance companies located in IFSC.

- Exemption for certain income of Core Settlement Guarantee Fund, extended to recognised clearing corporations in IFSC.

Tax Vivad Se Vishwas Scheme, 2024

- In order to provide resolution to certain income tax disputes pending in appeal, Direct Tax Vivad Se Vishwas Scheme, 2024 is proposed.

- Eligibility Criteria

| Sr. No. | Dispute Pertains to | Filing of appeal | If disputed amount deposited by December 31, 2024 | If disputed amount deposited after December 31, 2024 | |

| 1 | Tax | After January 31, 2020 but before July 23, 2024 | 100% of tax | 110% of tax | |

| 2 | Tax* | Prior to January 31, 2020 | 110% of tax | 120% of tax | |

| 3 | Interest or penalty or fees | After January 31, 2020 but before July 23, 2024 | 25% of interest/penalty/fees | 30% of interest/penalty/fees | |

| 4 | Interest or penalty or fees* | Prior to January 31, 2020 | 30% of interest/penalty/fees | 35% of interest/penalty/fees | |

*Provided at same forum presently as that of filing

Notes:

- Pendency of appeal should lie as on July 22, 2024.

- If declarant is wishing to settle a dispute where department is in appeal, then disputed tax shall be reduced to half of the above.

- For covered matters – In case where the declarant has received any favourable order from CIT(A) or ITAT and such order is not reversed at higher stage then disputed amount shall be reduced to half of the above.

- Not applicable to AYS in which assessment has been made pursuant to search or where prosecution has been instituted.

BLACK MONEY ACT, 2015

Immunity from penalty on non-reporting of small foreign assets

- Section 42 of the BMA imposes penalty for failure to furnish in return of income, a foreign income and asset held by an ordinary resident.

- Section 43 of the BMA imposes penalty for failure by an ordinary resident to furnish in return of income, an information or furnish inaccurate particulars about an asset (including financial interest in any entity) located outside India.

- Both the abovementioned sections prescribe penalty of an amount of INR 10 lakhs.

- Proviso to the said sections make an exemption in respect of an asset, being one or more bank accounts having an aggregate balance which does not exceed a value equivalent to INR 5 lakhs at any time during the previous year.

- It is proposed to substitute the said proviso to exempt an asset(s) (other than immovable property) where the aggregate value of such asset (s) does not exceed INR 20 lakhs.

- These amendments shall be applicable from October 1, 2024.

Prohibition Of Benami Property Transactions Act, 1988

Amendments in time limits

- Currently, provisions of the PBPT Act do not provide time limits to Benamidar and beneficial owner to respond to notices issued under section 24(1) and 24(2) of the PBPT Act.

- It is proposed to insert section 24(2A) wherein maximum of 3 months are allowed to Benamidar and beneficial owner to respond to such notices.

- It is proposed that time limit for Initiating Officer to pass an order under section 24(4) be increased to 4 months from the end of the month in which notice under section 24(1) was issued.

- It is also proposed that time limit under section 24(5) be increased to 1 month from the end of the month in which order under section 24(4) was passed.

- These amendments shall be applicable from October 1, 2024.

Immunity from penalty

- In order to incentivize Benamidar/abeter to be the whistleblower/ witness on Benami transactions, a new section has been introduced wherein the Initiating Officer has power to tender immunity to Benamidar/abeter from penalty under section 53 provided he is making true and full disclosure of the whole circumstances relating to the benami transaction.

International Tax/transfer Pricing Proposals

Reduction of tax rates in case of foreign companies

The base tax rate in case of foreign companies has been reduced from 40% to 35% (excludng surcharge and cess).

Inclusion of Specific Domestic Transactions under sub- section 2A and 2B of Section 92CA

- These sub-sections provide that when a reference is made to the Transfer Pricing Officer for assessment of an international transaction, the TPO can also include at his discretion, any other international transactions:

- which has not been referred by AO to TPO

- details of which have not been furnished in the audit report i.e., Form 3CEB as per section 92E

- which comes to his notice in the Transfer Pricing assessment proceedings.

- These sub-sections are amended to clarify that the TPO can also include any other Specified Domestic Transactions in the Transfer Pricing assessment proceedings at his discretion.

- These amendments shall be applicable from 1st April 2025.

Financial Companies in IFSC are not subject to Section 94B

- In case interest expenditure is incurred by an assessee by way of debt from an Associated Enterprise which exceeds INR 1 crore, specific guidelines have been stipulated regarding the interest expenditure allowed as an expenditure.

- Earlier this interest deduction limit was not applicable to Indian Companies or a permanent establishment of foreign companies engaged in the business of banking or insurance. The amendment has extended this exception to finance companies located in any International Financial Services Centres as well.

- These amendments shall be applicable from 1st April 2025.

Amendment of provisions related to Equalisation Levy

- Previously, a 2% levy was imposed on the amount of consideration received/receivable by an e-commerce operator from e-commerce supply or services.

- However, the scope of this levy was ambiguous and increased the compliance burden.

- In view of this, the equalisation levy (pertaining to e-commerce supply or services) is proposed to be removed with effect from August 1, 2024 and shall therefore apply only to transactions undertaken between April 1, 2020 and July 31, 2024.

DRP route not available for Search and Block Assessments

- Section 144C allowed objections to DRP for eligible assessees which means any person whose income is adjusted as a result of a transfer pricing order under section 92CA(3) or any non-resident not being a company.

- It is proposed that a proviso to sub-section 15 be introduced wherein definition of ‘eligible assessee’ excludes persons referred to in section 158BA and section 158BD.

- Also, a new sub-section 16 is proposed to be introduced which provides that section 144C is not applicable to any proceedings under Chapter XIV-B. This amendment provides that persons under search and block assessment shall not be eligible to litigate through DRP route.

- This amendment shall applicable from September 1, 2024.

Other announcements with respect to Transfer Pricing

The Hon’ble Finance Minister announced in her speech that to reduce litigation and provide certainty in international transactions:

- Scope of Safe Harbour Rules would be expanded (Safe Harbour Rules provide pre- determined Arm’s Length Prices which shall be accepted by tax authorities), and

- Streamline of transfer pricing assessment procedure

The above shall be provided in the Rules or the Act.

Indirect Tax Proposals

Customs – Key Changes

- Section 28DA of the Customs Act is being amended, so as to enable the acceptance of different types of “proof of origin” provided in trade agreements to align the said provision with new trade agreements which provide for self-certification. (to come into force from the date of the enactment of the Finance Bill)

- Government empowered to specify certain manufacturing processes and other operations in relation to a class of goods that shall not be permitted in a warehouse. (to come into force from the date of the enactment of the Finance Bill)

- Notification providing for exemption from levy of compensation cess on imports in SEZ by SEZ unit or developer for authorised operations, validated to be made effective retrospectively with effect from July 1, 2017.

- Changes have been made in import duty Tariff rates of number of items, some effective from July 24, 2024 and some from October 1, 2024. Changes has been made in export duty on specified items effective from October 1, 2024. Exemption in respect of certain items have been extended up to March 31, 2026 and some up to March 31, 2029. And in respect of few specified items the exemption being allowed to lapse with effect from September 30, 2024. Certain specified items are exempted from levy of Social Welfare Surcharge effective from July 24, 2024. Agriculture Infrastructure and Development Cess is reduced on specified precious metals effective from July 24, 2024.

- Currently, articles of foreign origin can be imported into India for repairs subject to their re-exportation within six months extendable to one year. The duration for export in the case of aircraft and vessels imported for maintenance, repair and overhauling is increased from six months to one year, further extendable by one year. This is effective from July 24, 2024.

- The time-period of duty-free re-import of goods (other than those under export promotion schemes) exported out from India under warranty is increased from three years to five years, further extendable by two years. This is effective from July 24, 2024.

GST-KEY LEGISLATIVE CHANGES (To be effective from date to be notified except as specified)

Levy of GST:

- No levy of GST on un-denatured extra neutral alcohol or rectified spirit used for manufacture of alcoholic liquor for human consumption.

- New Section 11A to be inserted in CGST Act so as to empower the Government to regularize non-levy or short levy of GST, where it is satisfied that such non-levy or short- levy was a result of general / common trade practices.

- Following activities to be treated as neither supply of goods nor supply of services –

- activity of apportionment of co-insurance premium by the lead insurer to the co- insurer for the insurance services jointly supplied by the lead insurer and the co- insurer to the insured in coinsurance agreements, provided that the lead insurer pays the GST liability on the entire amount of premium paid by the insured.

- the services by the insurer to the re-insurer, for which the ceding commission or the reinsurance commission is deducted from reinsurance premium paid by the insurer to the reinsurer, provided that GST liability on the gross reinsurance premium inclusive of reinsurance commission or the ceding commission is paid by the reinsurer.

Time of supply:

- The time of supply of services in cases where the invoice is required to be issued by the recipient of services in case of reverse charge supplies would be the date of issue of invoice by the recipient.

Input tax credit:

- Time limit to avail input tax credit in respect of any invoice or debit note under Section 16(4) of CGST Act, through any return in FORM GSTR 3B filed up to November 30, 2021 for FY 2017-18, 2018-19, 2019-20 and 2020-21, to be deemed to be November 30, 2021 (amendment to be effective from July 1, 2017). Where the GST has been already paid or the input tax credit has been reversed, no refund can be claimed of the same.

- The provisions of section 16(4) of CGST Act relaxed for availment of input tax credit in respect of any invoice or debit note in cases where returns for the period from the date of cancellation of registration or the effective date of cancellation of registration till the date of order of revocation of cancellation of the registration, are filed by the registered person within thirty days of the order of revocation of cancellation of registration, subject to the condition that the time-limit for availment of credit should not have already expired under section 16(4) on the date of order of cancellation of registration. (amendment to be effective from July 1, 2017). Where the GST has been already paid or the input tax credit has been reversed, no refund can be claimed of the same.

- The restriction of non-availability of input tax credit of GST paid under section 74 would apply only for demands up to FY 2023-24. The restriction of non-availability of input tax credit of GST paid under section 129 and section 130 has been removed.

Invoicing:

- Government empowered to prescribe by rules the time limit for issuance of invoice by the recipient in case of supplies liable under reverse charge mechanism.

Return:

- The registered person required to deduct GST at source will be required to mandatorily file the return for each month electronically, irrespective of whether any deduction has been made in the said month or not. Government empowered to prescribe by rules, the form, manner and the time within which such return shall be filed.

Refunds:

- Refund in respect of goods, which are subjected to export duty, is restricted, irrespective of whether the said goods are exported without payment of GST or with payment of GST, and such restrictions be also applicable, if such goods are supplied to a SEZ developer or a SEZ unit for authorized operations.

Summons:

- An authorised representative will be allowed to appear on behalf of the summoned person before the proper officer in compliance of summons issued by the said officer.

Demands:

- A common time limit of 42 months from the due date of filing of Annual Return is now provided for issuance of demand notices and orders in respect of demands for FY 2024-25 onwards, in cases involving charges of fraud or wilful misstatement and not involving the charges of fraud or wilful misstatement etc. Currently, there is a difference in time limit, which has been restricted for applicability up to F.Y. 2023-24. [applicability of Section 73 and section 74 has been restricted up to F.Y. 2023-24 and new section 74A proposed to be inserted]

- The time limit for the taxpayers to avail the benefit of reduced penalty, by paying the GST demanded along with interest, be increased from 30 days to 60 days.

- The penalty demanded in a notice invoking penal provisions with charges of fraud, wilful misstatement, or suppression of facts would be redetermined where such charges are not established.

Appeals:

- Amount of pre-deposit required to be paid for filing of appeals – maximum amount for filing appeal with the appellate authority to be reduced from INR 25 crores CGST and INR 25 crores SGST to INR 20 crores CGST and INR 20 crores SGST.

- Principal bench of GST Appellate Tribunal to be empowered for handling of anti- profiteering cases.

- Government to be empowered to notify the date for filing appeal before the Appellate Tribunal and provide a revised time limit for filing appeals or application before the Appellate Tribunal. [this amendment is proposed to be made effective form August 1, 2024]

- Amount of pre-deposit for filing appeal with GST Appellate Tribunal to be reduced from 20% with a maximum amount of INR 50 crores CGST and INR 50 crores SGST to 10% with a maximum of INR 20 crores CGST and INR 20 crores SGST.

Penalty:

- Penal provision in section 122(1B) of CGST Act to apply only for those e-commerce operators, who are required to collect GST under section 52 of CGST Act, and not for other e-commerce operators. [this amendment is proposed to be made effective retrospectively from October 1, 2023]

Waiver of interest:

- Conditional waiver of interest and penalty relating to demand notices issued under Section 73 of CGST Act for period from July 1, 2017 to March 31, 2020 in cases where the taxpayer pays the full amount of GST demanded in the notice upto the date as may be notified by the Government [the GST Council had earlier recommended this date as March 31, 2025]. Waiver shall not cover demand of erroneous refunds. Where interest and penalty have already been paid in respect of any demand for the said period, no refund shall be admissible for the same.

Transitional input tax credit:

- Enable availment of the transitional credit of eligible CENVAT credit on account of input services received by an Input Services Distributor prior to the appointed day, for which invoices were also received prior to the appointed date. [this would be made effective retrospectively from July 1, 2017]

Anti-profiteering:

- Government to notify the date from which the Authority shall not accept any application for anti-profiteering cases. [the GST Council had earlier recommended this date as April 1, 2025]

Glossary Of Terms

| Abbreviation | Meaning | ||||

| Act | Income-tax Act, 1961 | ||||

| AIF | Alternate Investment Funds | ||||

| AO | Assessing Officer | ||||

| AY | Assessment Year | ||||

| BCD | Basic Customs Duty | ||||

| BMA | Black Money Act | ||||

| CESTAT | Customs Excise and Service Tax Appellate Tribunal | ||||

| CGST Act | Central Goods and Services Act, 2017 | ||||

| CGST Rules | Central Goods and Services Rules, 2017 | ||||

| CST | Central Sales Tax | ||||

| CTA | Customs Tariff Act, 1975 | ||||

| Customs Act | Customs Act, 1962 | ||||

| DRP | Dispute Resolution Panel | ||||

| DTAA | Double Taxation Avoidance Agreement | ||||

| FY | Financial Year | ||||

| GST | Goods and Services Tax | ||||

| GSTN | Goods and Service Tax Network | ||||

| HUF | Hindu Undivided Family | ||||

| ITR | Income Tax Return | ||||

| IFSC | International Financial Service Centre | ||||

| IFSCA | International Financial Service Centre Authority | ||||

| IGST Act | Integrated Goods and Services Tax Act, 2017 | ||||

| InvIT | Infrastructure Investment Trust | ||||

| NRI | Non-Resident Indian | ||||

| STT | Securities Transactions Tax | ||||

| OFS | Offer for Sale | ||||

| PBPT | Prohibition of Benami Property Transactions | ||||